Governança Corporativa - Sumário GRI

Corporate Governance

| Number of Members | ||

Board |

Independent directors |

6 |

Other non-executive directors |

8 |

|

Employee representatives |

- |

|

Executive Board |

Executive directors |

7 |

Total |

21 | |

Klabin’s Board of Directors is composed of 14 full members and 14 alternates, elected at the General Shareholders’ Meeting, six of whom are independent. The Board is responsible for defining and guiding the Company’s long-term strategy and decision-making. Independent Directors are defined in accordance with the Level 2 Listing Rules of B3.

Information based on the Reference Form dated May 30, 2025, the Bylaws, and the Internal Rules of the Board of Directors.

| Full Board Members: 14 | Independent/Non-Executive | Gender | Years of Service* | Participation in Advisory Committees |

|---|---|---|---|---|

| Amanda Klabin Tkacz – Presidente | - | Female | 25 | - |

| Alberto Klabin | - | Male | 26 | - |

| Amaury Guilherme Bier | Yes | Male | 4 | Audit and Related Parties Committee |

| Celso Lafer | Yes | Male | 21 | - |

| Francisco Lafer Pati | - | Male | 25 | - |

| Horacio Lafer Piva | - | Male | 26 | - |

| Isabella Saboya de Albuquerque | Yes | Female | 4 | - |

| Lilia Klabin Levine | - | Female | 26 | - |

| Marcelo Mesquita de Siqueira Filho | Yes | Male | 3 | - |

| Mauro Gentile Rodrigues da Cunha | Yes | Male | 7 | - |

| Paulo Sergio Coutinho Galvão Filho | - | Male | 26 | - |

| Roberto Luiz Leme Klabin | Yes | Male | 26 | Sustainability Committee |

| Vera Lafer | - | Female | 26 | - |

| Wolff Klabin | - | Male | 20 | People and Culture Committee |

Alternate Board Members |

Independent/Non-Executive |

Gender |

Years of service* |

Participation in Advisory Committees |

Daniel Miguel Klabin |

- |

Female |

26 |

- |

Maria Silvia Bastos Marques |

- |

Female |

2 |

- |

Victor Borges Leal Saragiotto |

Sim |

Male |

3 |

- |

Paulo Roberto Petterle |

Sim |

Male |

3 |

Sustainability Committee |

Luis Eduardo Pereira de Carvalho |

- |

Male |

7 |

- |

Henrique Guaragna Marcondes |

- |

- |

- |

People and Culture Committee |

Adriano Cives Seabra |

Sim |

Male |

- |

- |

João Adamo Junior |

- |

Male |

3 |

Audit and Related Parties Committee |

Marcelo de Aguiar Oliveira |

Sim |

Male |

3 |

- |

Tiago Curi Isaac |

Sim |

Male |

6 |

- |

Maria Eugênia Lafer Galvão |

- |

Female |

5 |

Sustainability Committee |

Marcelo Bertini de Rezende Barbosa |

Sim |

Male |

12 |

People and Culture Committee |

Antonio Sergio Alfano |

- |

Male |

5 |

- |

Pedro Silva de Queiroz |

- |

Male |

2 |

Audit and Related Parties Committees |

* The current average tenure of the Board of Directors is 12.21 years, considering full and alternate members.

Average participation in Board of Directors meetings:

In 2024, full Board members recorded an average attendance rate of 85% at meetings.

Minimum required participation in meetings of the Board of Directors:

According to Article 16 of the Internal Rules of the body, members must attend at least 75% of the meetings of the Board and/or the Committees to which they belong, in order to actively and diligently perform their duties, such as reviewing the documents made available.

Non-Executive President/Chief Director

According to Klabin’s Bylaws (Art. 17, § 1), the Chair of the Board of Directors shall be elected by the Board itself from among the Directors elected by the Controlling Shareholder. The election of the Chair shall follow the principle of rotation, except in the case of re-election when approved by all Directors elected upon the proposal of the Controlling Shareholder. The current Chair of the Board of Directors is Director Amanda Klabin Tkacz, who does not hold an executive position in the Company.

Board Election and Nomination Process

The election of the members of the Company’s Board of Directors takes place through the slate system or by multiple voting, as applicable. In the election by slate, each shareholder may vote for only one slate, and the candidates of the slate receiving the highest number of votes shall be declared elected. Alternatively, the election may occur through the multiple vote procedure if shareholders jointly representing at least 5% (five percent) of the Company’s voting capital request its adoption, pursuant to Article 141 of Law No. 6,404/76 and CVM Resolution No. 70/22. In this case, the election will be carried out on a candidate basis, and each share will be entitled to as many votes as there are seats to be filled on the Board of Directors through the multiple vote procedure. Each shareholder may freely allocate their votes among the candidates, with those receiving the highest number of votes being elected.

Board Performance Review

The Board of Directors conducts an annual self-assessment of its activities, identifying opportunities for improvement in its performance. In this regard, self-assessment processes were carried out for fiscal years 2024, 2023, and 2022, and, with respect to fiscal years 2021 and 2024, an external evaluation was conducted by an independent consulting firm specialized in the subject. The self-assessment and external evaluation process included reviews of the structure in which the Board of Directors operates, the dynamics of meetings and interactions among Directors, strategy, duty of care, human capital, monitoring of Financial Statements, and risk and compliance.

The results of the evaluations are analyzed in light of statutory, regulatory, and governance standards, best practices, and benchmarks, as well as the Company’s strategic objectives and business. Based on the opportunities for improvement identified during the evaluation process and, when applicable, on the recommendations of the external consultancy, the evaluated bodies develop and implement action plans, within the scope of their respective responsibilities, with the support of the Company’s management and governance bodies.

Information based on the Reference Form dated May 30, 2025

Compensation Policy and compensation-setting process

Klabin’s fixed and variable compensation practices do not make distinctions based on gender, race, religion, or any other aspects not related to individual or corporate performance. In addition, all the Company’s leadership has targets related to Safety and to the KODS (Klabin Sustainable Development Goals).

The purpose of the Company’s compensation policies includes:

- Aligning the interests of employees with the Company’s and the shareholders’ strategy;

- Enabling our employees’ compensation to remain competitive and attractive compared to the market at large;

- Recognizing high-performing Klabin employees, fostering a meritocratic culture, and attracting and retaining talent for the Company;

- Causing executive compensation to reflect our short- and long-term results, in addition to their individual performance.

- The Company’s fixed and variable compensation policies make no distinction in terms of gender, race, religion, or any other aspects not associated with individual or corporate performance. In addition, executives operate under goals associated with KODS (Klabin Sustainable Development Goals), that is, relative to one of the four proposed theme axes (renewable future, sustainable economy, prosperity for people, and technology & innovation).

For the CEO’s compensation, the Company sets relative financial metrics and financial return, as shown below:

- Financial return: comparison of the Company’s annual average ROIC (Return on Invested Capital) and WACC (Weighted Average Cost of Capital).

- Relative financial metric: aligns compensation with the market performance of shares. Until 2022, this took place using TSR (Total Shareholder Return) and Ke (Cost of equity). The 2023 plan adopted the relative position between the Company’s TSR (Total Shareholder Return) and the TSR for the Peer Group of companies.

Deferral of the CEO’s Short-Term Compensation Bonus

- Concerning the breakdown of the CEO’s variable compensation, the following applies

- The CEO has the option to defer up to 50% of their short-term compensation into share purchases.

- The longest performance period that the executive compensation plan covers is five years, and the vesting period for variable compensation is five years as well.

Required Shareholdings

As of 2024, the CEO must allocate an amount equivalent to 30 monthly fees (based on his or her compensation at the end of each fiscal year) to the purchase of Company shares and maintain them in his or her possession (2.50x annual salary). For Statutory and Non-Statutory Executive Officers, the amount to be allocated to shares and held in their possession is equivalent to 18 monthly fees or salaries (1.50x annual salary), as applicable.

CEO-to-Employee Pay Ratio

| FY | Median Employee Compensation (BRL) | Ratio between Total Annual Compensation of the CEO and Median Compensation of Employees |

|---|---|---|

| 2023 | 77,640.67 | 214.2 |

| 2024 | 56,004.31 | 471.7 |

CEO succession plan

Klabin has a structured succession journey process, with governance established for all its stages and the direct involvement of the CEO. The process includes mapping succession paths for the Company’s leadership positions, including the CEO role. Current and future business needs are discussed and serve as the basis for defining the desired leadership profile. All directors are assessed annually to identify potential successors, a process supported by external consulting firms and periodic assessments that provide a group-level view and benchmarking against the market. Executives also have customized development plans that are closely monitored.

Information based on the Reference Form dated 05/30/25.

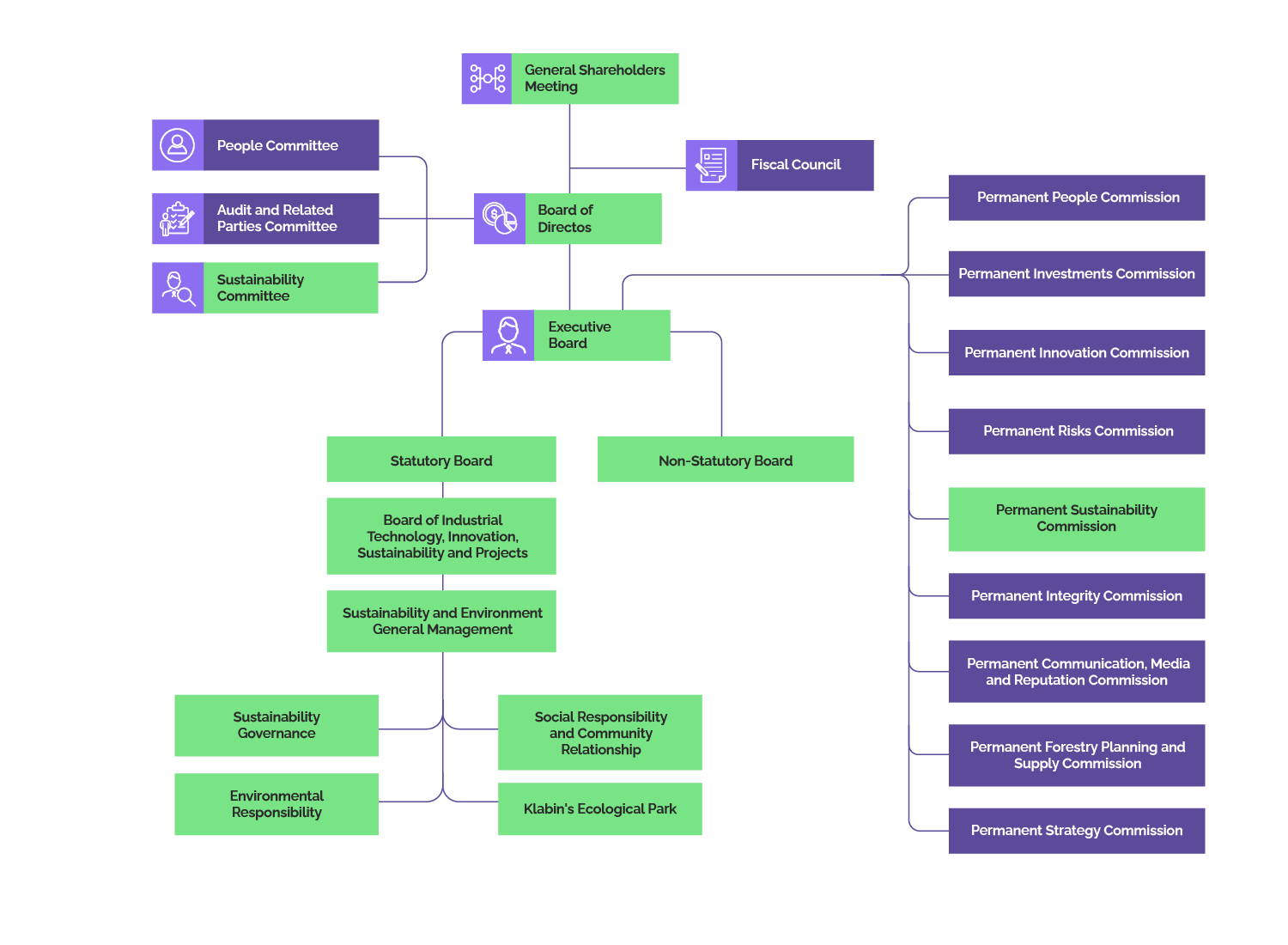

Sustainability Governance Structure

Klabin maintains a well-established governance structure to manage the strategic and operational execution of sustainability-related issues. This structure consists of: 1) Board of Directors advisory committees; 2) standing committees composed of executives to advise the Executive Board; 3) and a statutory board on Industrial Technology, Innovation and Sustainability, as well as corporate policies and internal controls focused on integrated management of sustainability-related risks. The Board of Directors is responsible for ultimate oversight of environmental, social and governance (ESG) issues, supported by dedicated committees such as the Sustainability Committee and the Audit and Related Parties Committee (both made up of board

members). These committees ensure that sustainability risks, impacts and opportunities are adequately considered in the formulation of business strategy and corporate decisions. In addition, executive sustainability management is supported by a Sustainability Standing Committee composed of Klabin executives, which is responsible for monitoring the implementation of actions planned for the area. Furthermore, within the Executive Board, the Company has a statutory Chief Sustainability Officer who is responsible for executing the sustainability agenda for the entire Company, reporting directly to the CEO.

Details of the governance bodies and their internal regulations, as well as corporate policies, are available on Klabin’s Investor Relations website (https://ri.klabin.com.br/) and in its Sustainability Policy.

Certifications

In 2022, Klabin's Sustainability Policy was updated and, therefore, training was conducted at the units and also through Klabin's Business School. The Sustainability Policy training covers all new employees (during the onboarding process) and direct and indirect training through the headquarters of each industrial unit.

| ISO 14001 CERTIFICATION | ||||

| Direct Employees | Indirect Employees | Total of Employees (Directs + Indirects) | Percentage of Units | |

| Number of Employees at Units | 14,242 | 5,665 | 19,907 | 100% |

| Total of Kablin's Employees | 14,242 | 5,665 | 19,907 | |

| Percentage of Employees covered by certification | 100% | 100% | 100% | |

All Klabin units in operation during the assessment period are certified under the ISO 14001 environmental management standard. In addition to information related to audits and certifications, Klabin’s forestry operations are certified by the FSC® and PEFC seals, which attest to responsible forest management based on ten principles, including: efficient use of multiple forest products and services, employee and community well-being, biodiversity conservation, detailed management plan, and monitoring and assessment of environmental and social impacts. Klabin also holds other quality certifications, such as American Institute of Baking (AIB), ISEGA, FSSC 22000, ISO 9001 and ISO 45001.

| ISO 9001 CERTIFICATION | ||||

| Direct Employees | Indirect Employees | Total of Employees (Directs + Indirects) | Percentage of Units | |

| Number of Employees at Units | 14,105 | 5,603 | 19,708 | 91% |

| Total of Kablin's Employees | 14,242 | 5,665 | 19,907 | |

| Percentage of Employees covered by certification | 99% | 99% | 99% | |

| ISO 45001 CERTIFICATION | ||||

| Direct Employees | Indirect Employees | Total of Employees (Directs + Indirects) | Percentage of Units | |

| Number of Employees at Units | 6,175 | 3,603 | 9,778 | 36% |

| Total of Kablin's Employees | 14,242 | 5,665 | 19,907 | |

| Percentage of Employees covered by certification | 43% | 64% | 49% | |

| ISO 50001 CERTIFICATION | ||||

| Direct Employees | Indirect Employees | Total of Employees (Directs + Indirects) | Percentage of Units | |

| Number of Employees at Units | 2,045 | 1,428 | 3,473 | 5% |

| Total of Kablin's Employees | 14,242 | 5,665 | 19,907 | |

| Percentage of Employees covered by certification | 14% | 25% | 17% | |

Since 2019, Klabin has maintained a structured materiality analysis process that underpinned the development of its 2030 Agenda. This initiative involved extensive consultations with different stakeholder groups, with the aim of identifying the main impacts to be mitigated and opportunities to be seized, using the global sustainable development agenda as a reference. The outcome of this process was the creation of Klabin’s Sustainable Development Goals (known by their Portuguese initials, KODS), composed of 23 material topics. In all, 11 of them involve long-term commitments, while 12 address internal company demands. (See Table 1.) The goals guide the Company’s sustainability strategy, including the composition of variable compensation for employees at all levels

KODS Topics (Classified as Material Topics Since 2019)

| Topics with public goals | Other relevant topics |

|---|---|

| Suppliers Social and Environmental Performance | Increased Forest Yield |

| Local Development and Impact on Communities | Forest Certification |

| Diversity | Ethical Conduct and Integrity |

| Ecosystems and Biodiversity | Klabin's Culture |

| Climate Change | Economic Performance |

| Products and Partnerships with the Value Chain and Circularity | Human Capital Development |

| Waste | Availability of Wood |

| Occupational Health and Safety | Innovation Management |

| Cybersecurity | Risk Management |

| Water Use | Management and Engagement of Professionals |

| Energy Use | Production and Logistics |

| Multiple Uses of Wood |

Klabin’s 2030 Agenda is revalidated annually by internal governance bodies. The agendas for Sustainability Committee and Sustainability Standing Committee meetings are set according to the risk and urgency of the topics and the progress of commitments. These meetings are held at least every two months.

Since the creation of the KODS Agenda, the appropriateness of all new company projects has been systematically analyzed in light of Klabin’s Sustainable Development Goals, internal audit control processes, periodic updates to the Risk Matrix and contributions from technical sponsors and the corporate Sustainability Area. Furthermore, the Company has included the achievement of some goals as trigger KPIs for some of its debts (see Sustainable Finance). The process for verifying the agenda’s compliance is also audited by a third party. In addition to the topics covered by the 2030 Agenda, all risks and recommendations arising from human rights due diligence conducted by Klabin are also internalized by means of the Company’s official monitoring activities.

Financial and risk approach to KODS topics

Since 2020, Klabin has been a Task Force on Climate-Related Financial Disclosures (TCFD) Supporter and committed to following the TCFD’s recommendations. The panel assesses not only the impact of climate change on Klabin’s long-term financial performance, but also the effects of the Company’s activities on society and the environment.

In the following years, the process was extended to other relevant topics, such as water and biodiversity. In 2023, Klabin expanded its Climate Transition Plan by incorporating elements of integrated soil, water and biodiversity management, accelerating the transition to a sustainable future. Considering this progress and the fact that, in Brazil, the main source of greenhouse gas emissions is land use change associated with deforestation, Klabin published its first Nature Transition Plan, in line with its commitment as an Adopter of the TNFD (Taskforce on Nature-related Financial Disclosures), starting in 2025.

Main advances in governance associated with Klabin 2030 Agenda

- A requirement to link the individual goals of all managers and executives to the KODS agenda, making up 20% of their variable compensation;

- The recurrence of Sustainability Standing Committee meetings, in order to regularly monitor and deliberate on changes of course and challenges related to the agenda, supported by an internal goal progress dashboard;

- A change in the use of the Sustainability Index, which was previously linked only to executives’ variable compensation, to provide all Klabin employees with short- and long-term financial incentives connected to the KODS Agenda;

- One-off reviews in terms of goals and timelines (e.g., the climate and net-zero goals approved by the SBTi);

- The publication of specific thematic guides to resilience strategies based on identifying risks and opportunities, such as the Climate Transition Plan and the Nature Transition Plan.

Expansion of approach: Double Materiality

The regulation of international standards – such as the European Sustainability Reporting Standards (ESRS), associated with the EU’s Corporate Sustainability Reporting Directive (CSRD) and IFRS S1, published by the International Sustainability Standards Board (ISSB) – represents an important milestone in the consolidation and standardization of global reporting practices.

In Brazil, CVM Resolution 193 of 2023 incorporates the international standards for sustainability information disclosure issued by the ISSB (IFRS S1 and S2). It establishes guidelines for sustainability disclosures by publicly traded companies, with voluntary adoption starting in 2024 and mandatory adoption starting in 2026 (base year).

Considering the regulatory outlook and market best practices, Klabin began reviewing its KODS topics in 2024, adopting the double materiality guidelines presented by the European Financial Reporting Advisory Group (EFRAG) as a methodological reference.

Carried out between February 2024 and June 2025, the new materiality process was structured in the following stages:

1. Analysis of convergence between the KODS topics and the ESRS’ mandatory sector topics;

2. Analysis of financial materiality (risks and impacts) for Klabin;

3. Consultation and analysis of impact on stakeholders and the environment;

4. Definition of double material, material and non-material topics;

5. Validation of Klabin’s new materiality;

6. Monitoring of indicators and internal controls for limited assurance;

7. Periodic review of materiality.

Analysis of convergence between the KODS topics and the ESRS’ mandatory sector topics

Based on the ESRS’ disclosure requirements for each topic and subtopic, a convergence analysis was performed for Klabin’s current materiality, with the aim of consolidating overlaps and simplifying the presentation of the Company’s material topics.

As a result, 12 material topics were redefined and submitted for analysis of: 1) the financial risks for Klabin; and 2) the impact on stakeholders and the environment. In addition to these, four other cross-cutting and enabling topics were defined for the Company’s businesses and operations.

Analysis of risks and opportunities for Klabin

Subsequently, the 12 material topics were reviewed to check the integration of their management and internal controls into the Company's official Risk Matrix.

Scoring:

- Probability score, considering the Company's criticality and vulnerability, i.e., occurrence, maturity of internal controls, and likelihood of risk occurrence;

- Severity score, considering the prospective financial impact and likelihood of risk occurrence.

Assumptions:

- The risk analysis methodology stipulated in Klabin's Risk Management Policy;

- The score of the most critical risk for each topic was considered;

- Minimum indicators were obtained from correlating risks involving each of the 12 KODS topics with more than 200 mandatory indicators;

- Opportunities are not yet incorporated into this version of our materiality exercise.

Approach and analysis:

- Meetings and workshops with the areas responsible for updating the classification and criticality of each risk related to the KODS topics, as well as proposing new risks, when necessary.

Analysis of impact on stakeholders and the environment

Calculation approach

- Consultation with stakeholders to determine the probability of impacts versus their severity (scale, dimension and irremediability1), if and when materialized;

- Conversion of existing primary data into a scale from 1 to 4.

Approach and analysis

An in-depth analysis was conducted of the impacts generated by the 12 topics on stakeholders and the environment. This process was conducted using primary data from reliable sources and recognized tools, in addition to a specific consultation to check the materiality of some topics not considered definitive.

For example, for certain topics, this analysis used external diagnoses, organizational climate data from employee consultations, matrices of social and environmental aspects and impatcs, human rights due diligence information, and technical reports aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) and Taskforce on Nature-related Financial Disclosures (TNFD).

In addition, 28 interviews were carried out with representatives of external stakeholders, including critical suppliers, significant customers across all businesses, industry associations, industry experts and non-governmental organizations, among other stakeholders considered relevant to Klabin's operations. This consultation resulted in probability and severity scores associated with four of the 12 prioritized topics: Resource Use and Circularity, Cibersecurity, Forest Certification, and Suppliers' Social and Environmental Performance. Primary data from previous consultations was utilized for the other topics.

Furthermore, Klabin's corporate policies and Code of Conduct guide its workforce on how to relate to stakeholders, establishing forms of interaction and frequency, as listed below:

1Permanent effects or damage, for which repair is impractical or impossible.

| Stakeholder | Type of engagement | Frequency |

|---|---|---|

| Employees | Meetings or direct contact; intranet; daily safety meetings | Daily |

| Customers | Contact by phone or email; audits; technical visits; Klabin team's presence at the customer's premises (occasional); customer portal | Daily and on demand |

| Suppliers | Contact by phone or email; negotiation meetings | Periodic and on demand |

| Regulatory bodies | Follow-up technical visits; contact by phone or email; sending electronic forms; investor reports; financial statements; investor portal. | Periodic and on demand |

| Investors | Meetings or direct contact; IR website; periodic information disclosed to Brazilian Securities and Exchange Commission (CVM); capital market events; visits to operations. | Daily |

| Communities | Communication channels (email, toll-free helpline, letters, interaction with employees in the field); in-person meetings; annual survey of communities | Daily |

All the consultation results were consolidated and integrated into analysis of the impacts of potentially material topics.

Definition of double materiality and other relevant topics

The impact of these topics on stakeholders is assessed by calculating severity multiplied by probability. Meanwhile, Klabin's financial materiality is determined by calculating the financial impact multiplied by vulnerability within the Company itself (Klabin's vision). The topics positioned in the double materiality area are considered priorities for both Klabin and its stakeholders. These are the topics for which full reporting is reasonable, according to both of the aforementioned regulatory standards.

Nevertheless, the areas of materiality are classified as of high importance and require public goals. To date, the non-material area does not have any established Klabin Sustainable Development Goals. Klabin is still in the process of surveying and calculating positive opportunities and impacts to make up the final matrix. The topics were reorganized into three strategic pillars for Klabin, distributed as follows:

Validation of Klabin's new materiality

The double materiality process was reported to, evaluated by and deliberated on by the following company bodies:

- Sustainability Standing Committee;

- Risk Standing Committee;

- Executive Board;

- Sustainability Committee;

- Risk Committee;

- Board of Directors.

Monitoring of indicators for assurance

The materiality process underwent external verification by a third party and is presented in the assurance letter available here.

Periodic review of materiality

Klabin’s new materiality framework will continue to undergo annual reviews, including calibration with the Company’s risks that were included in the material topics, material facts, achievement of goals associated with the topics, and referrals from meetings of the Sustainability Standing Committee and Sustainability Committee.

Regulatory Adaptation - IFRS/ISSB

Klabin is reviewing its internal processes and improving its data collection and analysis systems too meet the disclosure requirements established by IFRS S1 (Sustainability Information Disclosure) and IFRS S2 (Climate Risk Disclosure). Until the publication of the first limited assurance report, the thematic workbooks for each double material topic, in line with the new standards, can be found below:

- Climate Change: Klabin's Climate Transition Plan, based on Task Force on Climate-Related Financial Disclosures (TCFD) recommendations;

- Ecosystems and Biodiversity: Klabin's Nature Transition Plan, based on Taskforce on Nature-related Financial Disclosures (TNFD) recommendations;

- Water Use: Both sets of the aforementioned recommendations address this subject. However, by early 2026, the topic will have its own thematic workbook (Water Resources Management Plan), based on the same frameworks.

Regulatory Adaptation - ESRS

Klabin has been monitoring the implementation of ESRS (European Sustainability Reporting Standards) by the European Union and the reporting requirements for non-European companies. Based on this, it has restructured its Sustainability roadmap based on the concept of double materiality. This proactive approach allows Klabin not only to comply with future regulatory demands, but also to identify opportunities to improve internal processes and management practices on issues considered relevant to the company.

Materiality Issues and Metrics for Enterprise Value Creation

| Material Topic | Climate Change | Occupational health and safety | Biodiversity |

| Business Case | Klabin is a forestry-based company, and climate change risks directly influence crucial operational parameters such as forest yield, as well as operational and financial risks starting from planting, harvesting, and soil preparation. From the stakeholder’s perspective, the topic has been identified as a priority due to the potential impacts the company’s operations may generate. Therefore, the topic is considered double material, and the companyhas prioritized, in recent years, investments in mitigation and adaptation actions to address negative risks and impacts, as outlined in our Climate Transition Plan. In addition to the pipeline of projects and investments planned for decarbonization, Klabin also has public targets (KODS 2030) for science-based emission reductions and is part of various global climate initiatives such as the UN's Business Ambition for 1.5°C. The company is engaging its value chain to improve its emissions inventory reporting and report science-aligned targets. |

The Life Protection Policy was launched in 2022 and revised in 2024 and aims to promote a fair culture that cares for the well-being of employees and the business strategy, turning failures into learning experiences that drive safer processes and activities throughout Klabin. This topic is of extreme relevance to the company as it represents a risk directly associated with the continuity of operations, productivity, and the quality of life of our employees and third parties. It is directly linked to the business strategy and is present in long-term goals and in the variable compensation of the company’s executives. In 2025, Klabin completed its double materiality assessment. Although the topic of health and safety was not classified under double materiality, it remains a material issue in terms of impact for the company. This reflects Klabin’s ongoing commitment to continuously improving internal safety practices. |

Due to its forestry-based business, Klabin is a pioneer in implementing mosaic planting: a system that combines areas of preserved native forests, which correspond to almost half of our forest area, with planted forests of pine and eucalyptus of different ages. Since the quality of planted forests also depends on the quality of native forests and their natural resources, Biodiversity is a relevant topic for the company and has the largest set of targets for 2030 within Klabin's Sustainable Development Agenda. The loss of biodiversity threatens the ability of ecosystems to provide resources and services (e.g., pollen and seed dispersal, natural pest control, water and climate regulation, soil and nutrient conservation, etc.) that are essential for sustaining high yields of Klabin's plantations. In 2025, Klabin completed its double materiality assessment, and the topic was classified as a double material issue-meaning it is considered a priority both for the company and its stakeholders. |

| Business Impact | Risks | Risks | Risks |

| Business strategies |

|

Management of this topic is outlined in the Occupational Health and Safety Management System and is structured into 3 pillars: 1. Installation: Ensure the safety and reliability of equipment. Improve and maintain the working environment provided to our professionals; 2. Method: Continuously improve how we handle safety in our routine. Maintain a critical view of our accident prevention and mitigation procedures, creating and reviewing policies, guidelines, and requirements; and 3. People: Value good practices and encourage employees to take care of each other. Train them on standards and procedures and bring leadership closer to the routine. The Occupational Health and Safety Management System is guided by ISO 45001 in all manufacturing and forestry units, with guidelines and procedures focused on loss prevention and continuous process improvement to preserve life, health, and physical integrity of people. | Klabin evaluate the impacts of this risk through the Continuous Monitoring Program for Fauna and Flora. This allows understanding the behavior of species and adopting prevention and mitigation measures, such as reducing road accidents, reforestation actions, and scientific research. Klabin has a biodiversity research center in its Ecological Park, aimed at monitoring and restoring forest quality through wildlife restoration. It is also responsible for bringing technological solutions to accelerate and scale the Biodiversity Monitoring program, which includes species tracking. Additionally, one of the long-term goals of this topic is linked to a Sustainability-Linked Bond, increasing the company's commitment to its 2030 Agenda and its financial and strategic roadmap. In 2025, Klabin revised its Nature Transition Plan (former "Biodiversity and Ecosystem Services Conservation Plan"), aligned with its commitment as a TNFD (Taskforce on Nature-related Financial Disclosures) Adopter. |

| Long-term goal | In 2024, Klabin had new targets approved by the Science Based Targets initiative (SBTi), related to Scope 3 emissions and the most ambitious scenario aligned with limiting global temperature rise to 1.5°C. A long-term Net Zero target was also established, covering Scope 1+2, and Scope 3 emissions by 2050 (compared to the base year (2022). The targets include industrial and energy emissions:

|

At Klabin, safety is a core value of the Company. For this reason, its relevance and the continuous pursuit of improvement are non-negotiable. Given the materiality of the topic, Klabin has established the following long-term goals: i. Zero lives changed of own and contracted employees ; ii. Keep the accident frequency rate (own employees and contractors) below 1; iii. Maintain the severity rate of accidents with own and contracted employees below 50; iv. Achieve a more advanced level (Generative/Sustainable) in the Hearts and Minds methodology or equivalent. The achievement of these goals accounts for 10% of the variable compensation of directors, managers, coordinators, and specialists, in order to drive internal progress on this front. |

Our objectives/targets by 2030 are: (i) reintroduce two extinct species and reinforce four threatened species in forests by 2030; (ii) donate 1 million native seedlings; (iii) have at least 6 research partnerships per year; (iv) maintain or increase the number of native species dependent on forests; (v) map 100% of hotspots where fauna is run over and implement actions to reduce occurrences. |

| Target year | 2030 | 2030 | 2030 |

| Progress | Reduced 13.2% absolute Scope 1 and 2 emissions compared to the base year (2022); Reduced 17.4% absolute Scope 3 emissions compared to the base year (2022); |

i. 4 lives changed; ii. Accident frequency rate 1.82 iii. Severity rate: 220 iv. Percentage of units: 3% |

i. 2 species: Jacutinga (Aburria jacutinga) - Fauna reintroduction; Purple-breasted Parrot (Amazona vinacea) - Population reinforcement. ii. 32% of hotspots for fauna being run over mapped. iii. 76% of fauna species dependent on high environmental quality forests. iv. 10 partnerships/research projects per year based on nature conservation and biodiversity studies. v. 610,000 native tree seedlings for the recovery of degraded areas in partner areas. |

| Executive Compensation | In the annual short-term incentive program, starting in 2024, corporate and individual goals are used to measure the performance of each executive, with corporate goals comprising: financial indicators (70% of the total weight), safety (10% of the total weight), ESG indicators (10% of the total weight), and individual goals (10% of the total weight). Climate Change goals are linked to the 10% related to ESG indicators. |

In the annual short-term incentive program, starting in 2024, corporate and individual goals are used to measure the performance of each executive, with corporate goals comprising: financial indicators (70% of the total weight), safety (10% of the total weight), ESG indicators (10% of the total weight), and individual goals (10% of the total weight). |

In the annual short-term incentive program, starting in 2024, corporate and individual goals are used to measure the performance of each executive, with corporate goals comprising: financial indicators (70% of the total weight), safety (10% of the total weight), ESG indicators (10% of the total weight), and individual goals (10% of the total weight). As the company's biodiversity goals are part of the 2030 agenda, managers sponsoring the topic set goals linked to 10% of the individual goal for this topic. |

Material Issues and Metrics for External Stakeholders

| Material topic for external stakeholders | Biodiversity, Forest Certification; Water; Climate Change | Local Developmwnt |

| Category: Biodiversity | Category: Community impact and development | |

| Cause of the impact | Operations Supply Chain (> 50% of business activities) |

Operations (> 50% of business activities) |

| External stakeholders impact areas evaluated | Environmental |

Society |

| Topic relevance on external stakeholders | Both positive and negative: The Tragedy of the Commons considers the impacts resulting from the uncoordinated actions of economic agents around a common element that can become scarce if not managed collectively. The balance that Klabin must establish between forestry and water-intensive industrial operations. Water-intensive industrial operations can impact not only water issues, but also land use and local dynamics. Klabin has defined commitments to these externalities and a management system focused on territorial water security, prioritizing: Supplier certification: the sharing of socio-environmental competencies for effective landscape planning, aimed at conserving natural resources and productivity and guaranteeing sustainable forest management as a whole. Management of hydrosolidarity, which guides forest water management to keep 60% of forests standing in order to conserve watersheds and water availability, both quantitatively and qualitatively. | Positive: The presence of Klabin, especially in forest territories with a paper industry, affects the local dynamics, while the company and its local suppliers rely on a good relationship and a politically robust society to gain social acceptance and obtain social license to operate. Municipalities with strong social fabric can contribute more effectively to sustainable development, and governments with strengthened capacities rely on collaborative planning to guide their progress. In this relationship, the company's positive influence on social dynamics safeguards local quality of life and social relationships. Klabin maintains an economic, social, and environmental agenda with the communities where it operates, encompassing projects related to education and workforce training, support for family farming, regional solid waste management, and a program to assist public management planning. Through the Program for Support to Public Management, Klabin works to promote significant advancements in municipalities prioritized for the company's operations (see criteria below) by providing training and consulting services to enhance their planning and the utilization of public resources generated from taxes related to the company's activities. The objective of this initiative is to foster participative public management in municipalities that demonstrate below-average development indicators compared to similar municipalities. |

| Output Metric | Percentage of third-party areas covered by Matas Legais Program; Percentage of wood suppliers certified by FSC or similar methodology; Percentage of areas with hidrosolidarity management; Hectares sustainably managed; Hectares of restored native areas. |

Percentage of territories with participative management encouraged; |

| Impact Valuation | Environmental value lost/gained - Soil quality, water quantity, biodiversity KPIs | Quantified quality of life impacted - Communities well-being score (SPI) |

| Impact Metric | Hectares of restored forests: Enhanced environmental skills for wood suppliers, Water availability, Enhanced Forest productivity for wood suppliers, Increased restored native areas (Legal Reserve) |

Quantified quality of life impacted - Improved well-being in prioritary municipalities. |

Updated and verified on: -

02/09/25